Managing your finances in Debrecen begins with selecting the right bank account. However, understanding the various costs associated with banking services can be overwhelming. In this blog post, I will assist you in identifying the most cost-effective option for your financial needs by guiding you through the process of finding the lowest operating fees for bank accounts in Debrecen.

Even though Hungary is a member state of the European Union, it is not part of the Eurozone. The official currency of Hungary is called the forint, abbreviated as HUF or Ft. It is issued in both note and coin forms.

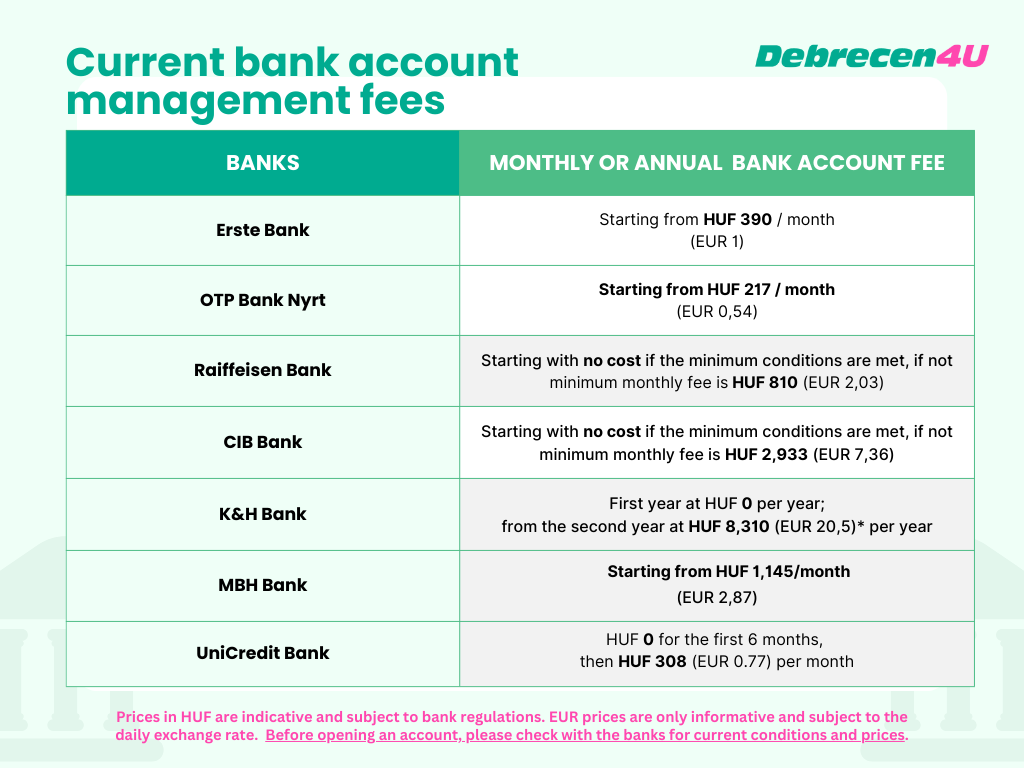

Some Debrecen-based major banks with walk-in branches and secure ATMs across Hungary include:

Erste Bank Erste Bank was founded in 1819 as the first Austrian savings bank and went public in 1997 with a strategy to expand its retail business in Central and Eastern Europe. Since then, Erste Group has grown to become one of the largest financial services providers in the EU and is also present in Debrecen.

Erste offers a discounted package fee that may vary each month, depending on the total value of transactions initiated on internet banking and mobile application services like George App and George Web. The monthly package fee ranges between HUF 390-990, based on the amount of electronic transactions initiated. It’s crucial to meet the conditions for the discounted monthly package fee, otherwise, it’s HUF 1,990.

OTP Bank Nyrt is a prominent financial institution headquartered in Budapest, Hungary. OTP Bank offers services such as currency exchange, private banking, insurance, personal and mortgage loans, and Internet banking. Its Basic Account S package offers a fee of HUF 217/month for a 6-month period if conditions like income to the account over HUF 100,000 are met. Otherwise, the monthly fee is HUF 796.

Raiffeisen Bank is one of Austria’s leading corporate and investment banks and operates as a universal bank in 12 Central and Eastern European markets. Its account “Activity 3.0” offers a discounted account management fee of up to HUF 0 if conditions like at least 4 transactions per month totaling a minimum of HUF 133,400 are met, along with an activated bank card.

CIB Bank is the leading private-sector bank in Egypt, offering a broad range of financial products and services to its customers, which include more than 500 of Egypt’s largest corporations, enterprises of all sizes, institutions, and households. It offers an ECO Bank account with a monthly management fee of HUF 0 if certain conditions are met; otherwise, it’s HUF 2562.

K&H Bank is one of the leading banks in Hungary in retail services as well as in the corporate segment. Their main objective is to offer the best solutions to their partners’ financial needs, which is why they are continuously working on improving our products and services. The bank’s “Minimum Plus Account Package” offers various preferential conditions, including free banking charges for the first year and an annual fee of HUF 7,258 from the second year.

MBH Bank was established as a result of a triple merger unique in Hungary and even on the financial markets of the CEE region. The first step of the transformation was the merger of Budapest Bank and MKB Bank in 2022, which was followed on 30 April 2023 by the Takarékbank also merging into MKB Bank. It offers an Introductory Account Package for HUF 1,145/month (HUF 1,374/month for electronic statements), along with a Card Issuance Fee of HUF 11,450 per card type for the first card application.

UniCredit Bank is a prominent banking group that provides financial services to individuals and families. UniCredit Bank in Hungary provides financial solutions for private individuals. Their services include online applications, calculators, security advice, bank cards, and bank mobility. Its “Basic Account” has a monthly account management fee of HUF 1,000, regardless of income.

Considering these options, you can select the bank account that best suits your financial needs while minimizing costs.